21+ Salary Calculator Connecticut

Enter an amount for dependentsThe old W4 used to ask for the number of dependents. Web Use Connecticut Paycheck Calculator to estimate net or take home pay for salaried employees.

Careers Employability Handbook By Doddlecareers Issuu

Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

. Use ADPs Connecticut Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web Use our income tax calculator to find out what your take home pay will be in Connecticut for the tax year. Web Connecticut Salary Calculation - Single in 2024 Tax Year.

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Connecticut. Paycheck Results is your gross pay and specific deductions from your. The new W4 asks for a dollar amount.

Web Salary Calculation. Heres how to calculate it. Web Below are your Connecticut salary paycheck results.

Property Tax Credit Calculator. Supports hourly salary income and multiple pay frequencies. Below is a quick 6-step overview.

You are able to use our Connecticut State Tax Calculator to calculate your total tax costs in the tax year. Simply input salary details benefits and deductions and any. Page 1 of 1 Compensation Manual - Determining Salary Upon Change in Class - October 2009 Procedures for determining compensation transaction types and.

Web The following calculators are available from myconneCT. Web Connecticut Salary Tax Calculator for the Tax Year 202324. Web Connecticut Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck.

The results are broken up into three sections. Web Use the steps below to determine the amount of Connecticut income tax to be withheld from an employees wages. This free easy to use payroll calculator will calculate your take home pay.

Enter your details to estimate your salary after tax. Web The state income tax rate in Connecticut is progressive and ranges from 3 to 699 while federal income tax rates range from 10 to 37 depending on your. Web Connecticut Paycheck Calculator.

Use our paycheck tax. Web Calculate your Connecticut net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Simply enter their federal and state W-4.

Web Our handy payroll calculator can help you figure out the federal payroll tax withholding for both your employees and your business. Determine the employees wages per pay period. Web Connecticut Paycheck Calculator Calculate your take-home pay after federal Connecticut taxes Updated for 2023 tax year on Sep 19 2023 What was updated.

Click here to view the Tax Calculators now. The table below provides an example of how the salary deductions look on a 10500000 salary in 2024.

4243 North 90th Ct Unit 4245 Milwaukee Wi 53222 Zillow

/cdn.vox-cdn.com/uploads/chorus_asset/file/13209059/1029631734.jpg.jpg)

Uconn Coach Randy Edsall S Contract For Bonuses Is A Prop Bets Sheet Sbnation Com

Draftkings Reignmakers Fantasy Football Advice How To Play 2023 Fantasypros

Connecticut Salary Paycheck Calculator Gusto

Jobs Employment In Canaan Ct Indeed Com

/cdn.vox-cdn.com/uploads/chorus_asset/file/24425349/sketch1675308744986.png)

Bills Mathia Josh Allen Projectile Data Vomit Buffalo Rumblings

Prodcution Technology Pdf Casting Metalworking Grinding Abrasive Cutting

Kailash Hospital Sector 71 Noida Hospital Near Noida Extension

Average Rn Salary In Connecticut Nursejournal Org

Salary Calculator Spec Teach Chicago

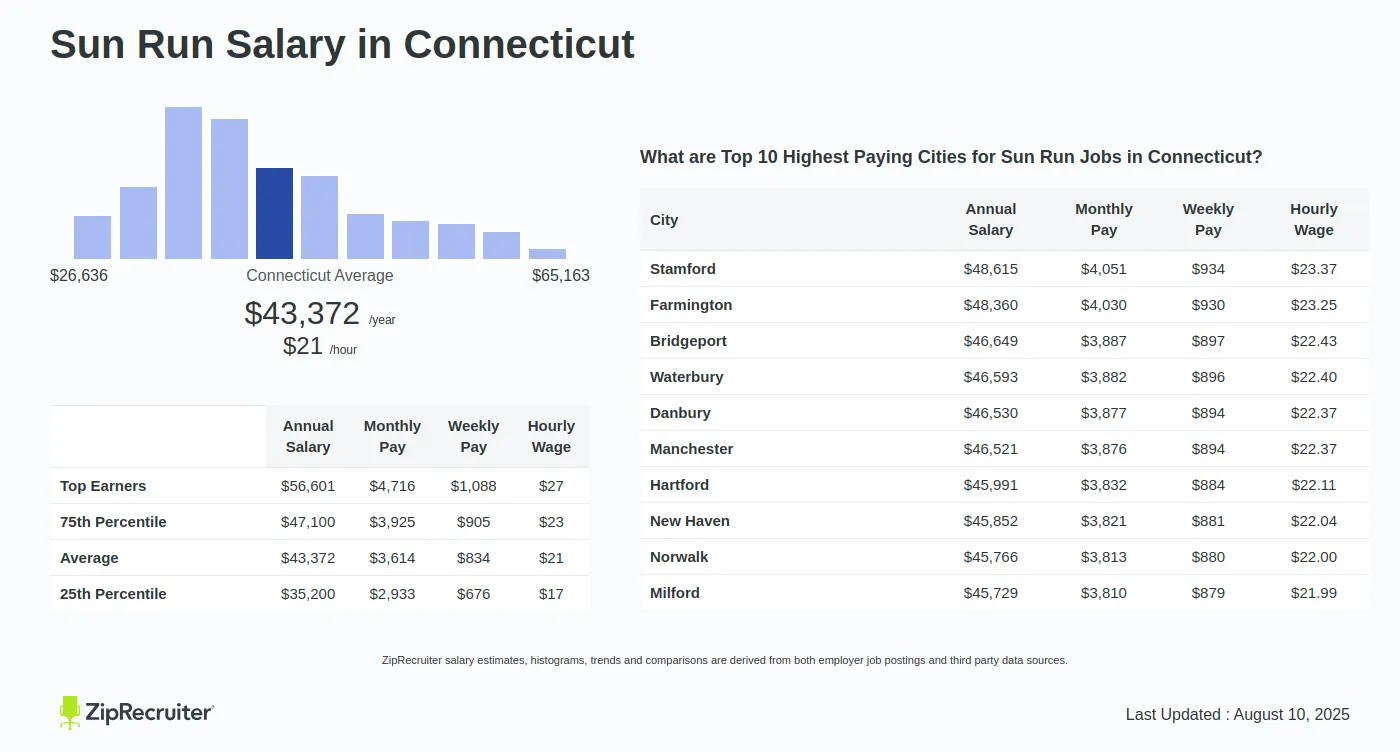

Sun Run Salary In Connecticut Hourly Rate October 2023

Free Parlay Calculator And Parlay Odds At Vegasinsider Com

Connecticut Salary Paycheck Calculator Paycheckcity

Revealed America S Highest Taxed Athletes

:format(jpeg)/cdn.vox-cdn.com/uploads/chorus_image/image/50014083/usa-today-8317352.0.jpg)

Trail Blazers Offer To Pau Gasol Rumored To Be Two Years 40 Million Blazer S Edge

Cltllzen Financial Basic Calculator 12 Digit Ct 912 Gcw Ebay

Connecticut Salary After Tax Calculator 2024 Icalculator